Discover what others can’t.

Unlock multi‑resource potential with a digital exploration platform.

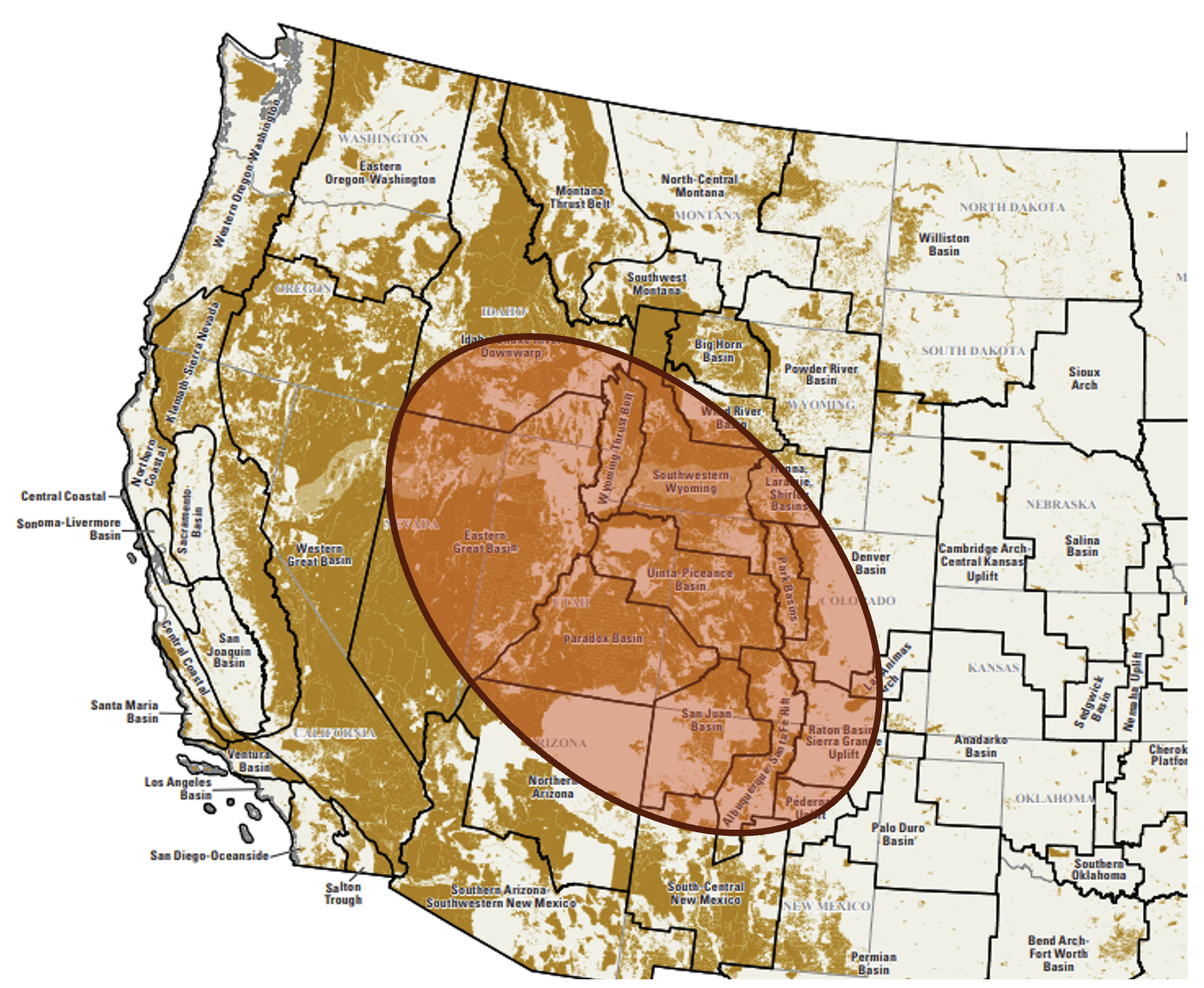

We scan 5,000 km² in months and deliver drill‑ready targets across oil, gas, helium, lithium, copper and other critical minerals — at a fraction of the cost, with up to 3× accuracy versus seismic drilling results. Faster, cheaper, de‑risked — built to assemble a multi‑resource portfolio with multi‑billion‑dollar monetization potential across the American West.

A generational window to build an asset‑class.

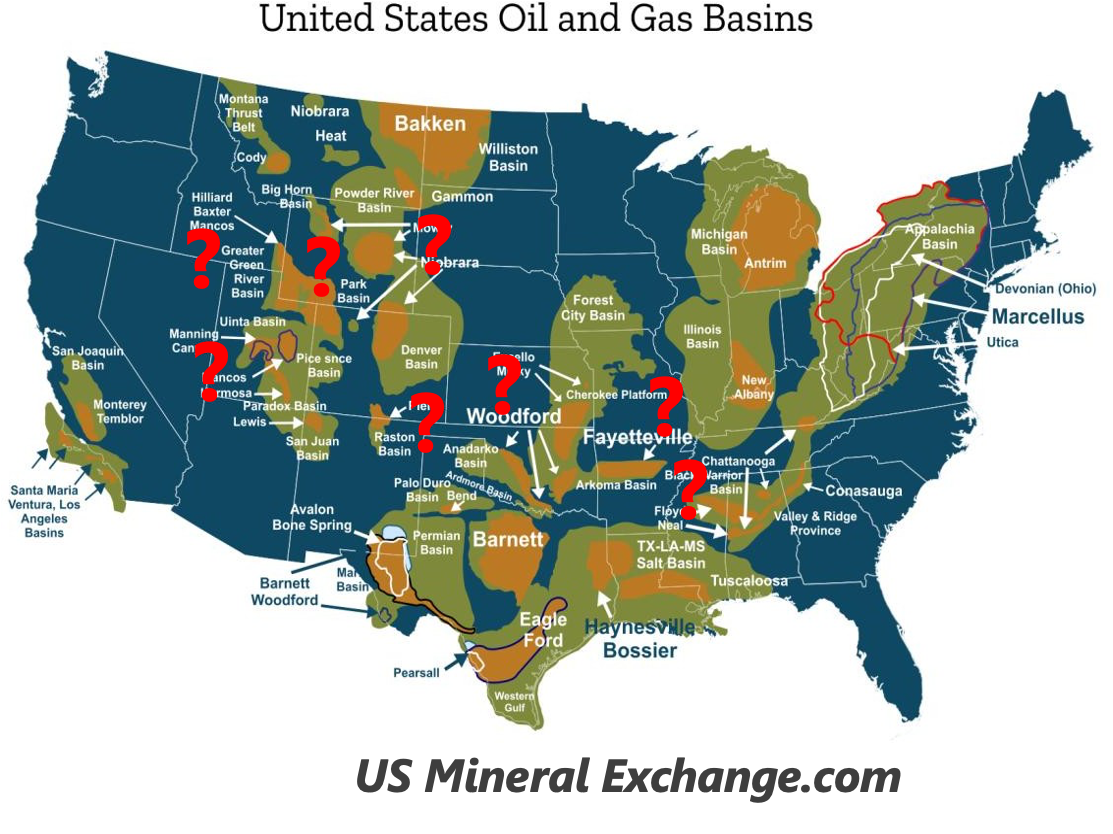

Federal lands are opening. The West holds overlooked oil & gas and critical minerals. Capital now rewards rapid execution, not slow exploration theory.

- Underexplored basins beyond shale, with high‑impact conventional opportunities.

- Growing national demand for copper, uranium, helium, lithium in the energy & defense supply chain.

- We start where others stopped: overlooked, structurally complex, seismic‑blind basins.

Execution focus

Two tracks drive returns from Day One: near‑field yield and frontier discovery. We discover, de‑risk, and flip; we don’t develop.

- Lease 1M+ acres of tier‑1 prospects

- Drill 25–30 wells and 15 cores

- In 5–7 years generate $3-11 Billion in monetizable resources

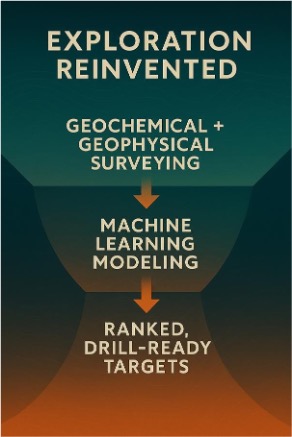

From proxy‑guessing to direct detection.

We combine digital geochemistry, physics and AI to detect resources directly from the surface — delivering ranked, drill‑ready targets in weeks.

Helium DRI — the resource fingerprint

- Helium migrates with fluids, revealing active systems via surface anomalies.

- Signals map permeability, pressure and charge — not just structure.

- Most effective in underexplored or seismic‑blind basins.

Modular multi‑resource toolkit

We integrate in‑house and licensed tools into one software workflow:

- AI‑ranked Helium DRI, gamma isotope spectrometry

- Shallow/Deep TEM & MT, passive seismic

- Hyperspectral imaging, gravity/gravity wave, mineral vein mapping

Two tracks. One goal: compounding returns.

Blend high‑upside discovery with near‑term results to make progress immediately.

Track 1 — Near‑field yield

- Partner with operators in known basins to high‑grade prospects and locate bypassed pay.

- Short‑cycle recompletions and new drills.

- Commercialization via operator programs with rapid operational cycles.

Track 2 — Monetizable exploration

- Validate leads where drill paths are missing, fund initial wells/cores.

- JV and data‑sharing paths; stage‑gated participation to retain long‑term technical exposure.

- Critical minerals JV verticals alongside core oil plays.

Building the portfolio others will compete to buy.

Anchor value in core basins; flip early successes to accelerate expansion; retain strategic interests in each success.

- 200k acres already leased for energy exploration

- 28 O&G prospects identified; active copper prospect

- Lead pipeline across multiple Western states

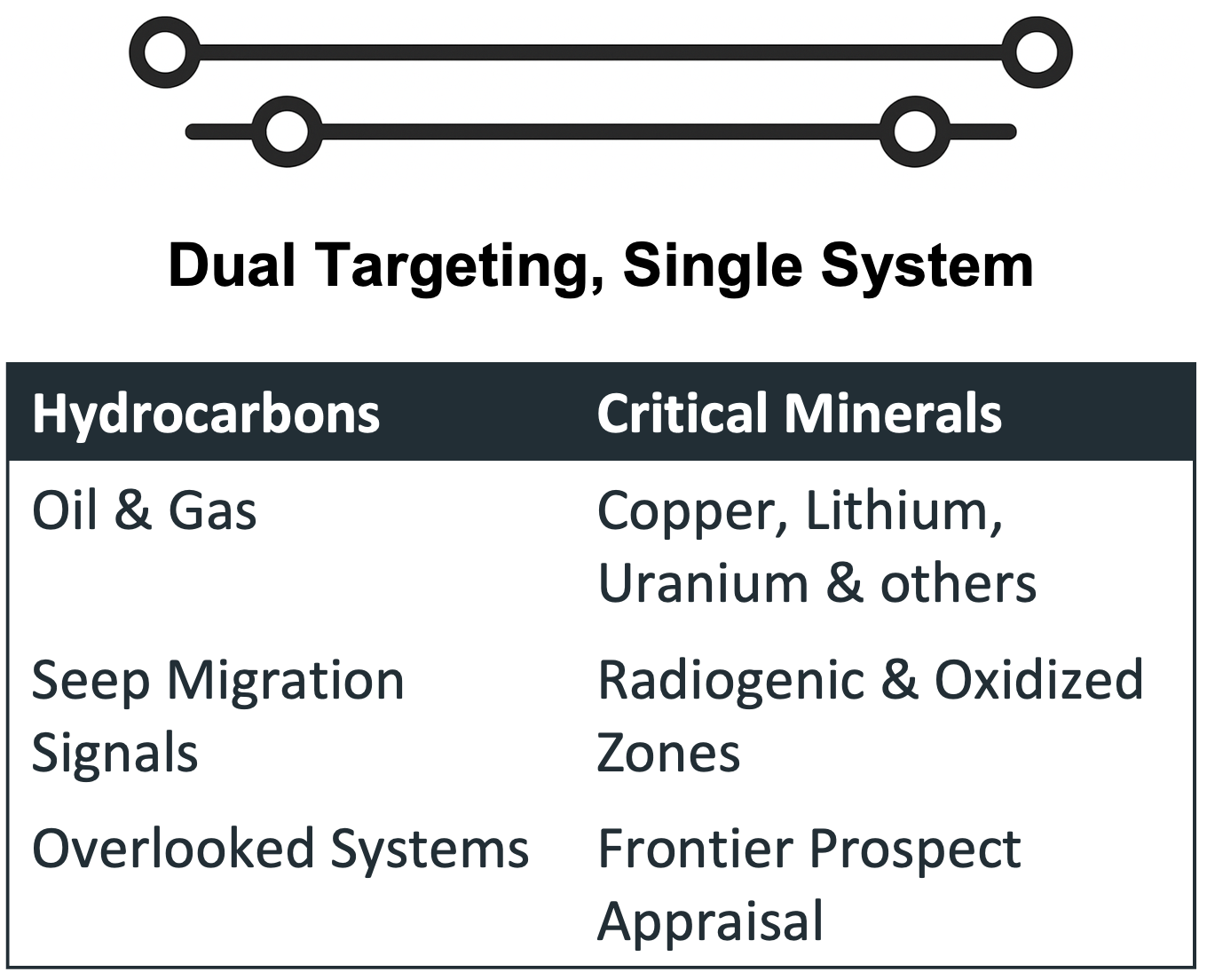

Dual‑targeting, single system

Every survey builds a multi‑layer dataset for oil, gas, helium, lithium, copper and uranium—creating mineral IP at near‑zero marginal cost.

Dataset vision: 25,000 sq mi, AI‑ready geochemical & physics signals across the American West.

Field‑validated performance.

Case studies from complex basins and lithium brines demonstrate predictive accuracy and speed from scan to target. Proven technology: hundreds of project deployments and successful wells drilled with the technology globally.

- 11 significant helium anomalies near target area

- Exploration well drilled on our highest anomaly

- ~317 bbl/d oil & ~4.24 MMcf/d gas on test

- Helium anomalies correlate with conductive brine zones

- Ranked drill target within 15 days

- Workflow scales from regional to prospect

- Oil & gas prospects co‑located with critical minerals

- Leasing strategy accelerated by early signals

- Stacked optionality reduces portfolio risk

Team built to accelerate multi‑resource discovery.

Deep subsurface science, operations and capital markets experience.

From scan to production: a focused 5–7‑year program.

Focused five‑to‑seven‑year program to assemble, appraise and monetize stacked oil & minerals assets.

- Survey 25,000 sq mi across Western U.S.

- Lease & high‑grade 1M acres of tier‑1 prospects

- Drill 25–30 exploratory/appraisal wells and identify proven reserves

Program pillars (5‑year)

- Start with O&G exploration campaigns

- Multi‑resource exploration campaigns

- Strategic lease & royalty positions

- Drilling & appraisal programs

- Team & operations runway

Exploring responsibly.

Non‑intrusive tech, lower emissions conventional wells, reduced surface disruption, and community‑first planning.

- No hydraulic fracturing required in our conventional focus areas

- Modular sites, minimized traffic, electric rigs where applicable

- Renewable alignment: detection of lithium and natural hydrogen potential

Request a confidential briefing.

Share your details and we’ll schedule time with the founding team.